Yes, Delta Dental can be absolutely worth it if you choose the right plan for your needs and use it wisely.

Dental insurance can feel like a gamble. You’re paying a monthly premium, hoping it’ll pay off when you finally need care. So, how do you know if Delta Dental is worth the cost? In this guide, we’ll help you figure that out with real-world examples, cost breakdowns, and honest pros and cons.

Whether you’re a parent looking for coverage for your kids, a senior needing dental implants, or someone just trying to cover cleanings and fillings, this post will help you understand how Delta Dental stacks up.

Key Takeaways

✔ Delta Dental covers preventive, basic, and major dental services depending on plan type

✔ PPO plans offer flexibility and broader coverage; DHMO plans keep costs predictable

✔ Worth it for most families, adults, and seniors — especially when used strategically

✔ Not ideal for cosmetic-only needs or infrequent visitors

✔ Use cleanings, pre-authorizations, and benefit-year planning to maximize savings

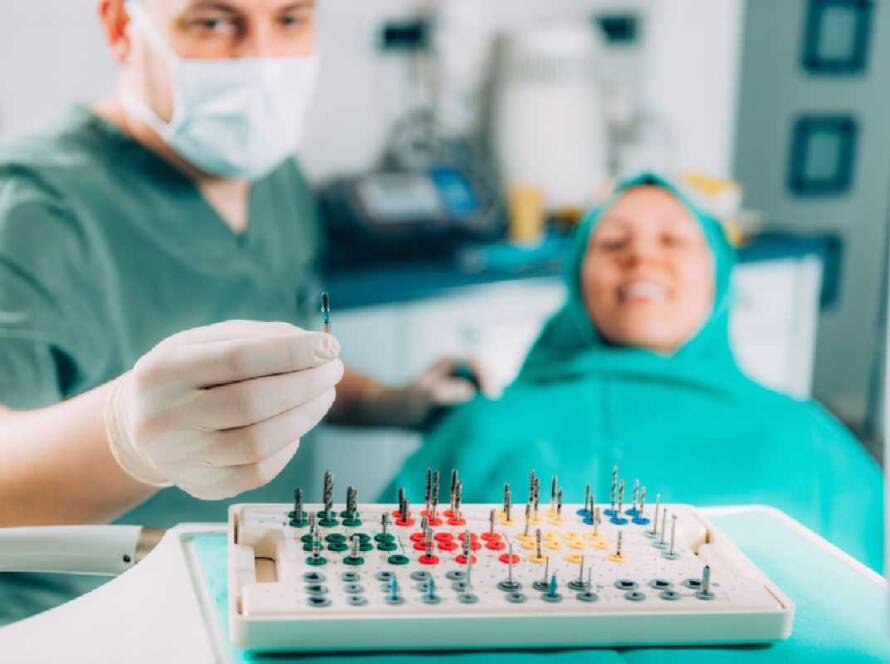

What Is Delta Dental and What Plans Do They Offer?

Delta Dental is one of the largest dental insurance providers in the United States. Their reputation? Solid. Their plan options? Pretty versatile. Here’s what they offer:

- Delta Dental PPO — Reimbursement-style plan with flexibility and broad dentist access

- DeltaCare USA (DHMO) — Copay-based plan with predictable costs and network restrictions

- Individual & Family Plans — Available on health marketplaces and directly

- Employer-Sponsored Group Plans — Often come with better benefits and lower costs

Delta Dental also offers vision coverage through DeltaVision in select states.

What’s Covered Under Delta Dental Plans?

Coverage varies depending on the plan, but generally includes:

- Preventive care (cleanings, exams, X-rays): Often 100% covered

- Basic services (fillings, simple extractions): Covered at 70 to 80 percent

- Major services (crowns, dentures, root canals): Usually covered at 50 percent in PPO plans

- Orthodontics: Covered in many group plans for kids under 19, limited for adults

- Implants: Covered in select PPO plans, rarely in DHMO plans

Be mindful of waiting periods, annual maximums, and deductibles that can affect when and how much coverage you get.

Delta Dental PPO: Is It Worth It?

This is Delta’s most flexible plan type. It’s great for people who want to:

- Pick their own dentist

- Access care out-of-network if needed

- Receive partial coverage on major procedures like crowns or implants

Pros:

- Broad provider network

- Coverage for out-of-network care

- Strong preventive and restorative benefits

Cons:

- Monthly premiums can be higher

- Annual maximums can be as low as $1,000, which doesn’t go far if you need serious work

If you need flexibility and might require major dental treatment, the PPO is a strong contender.

DeltaCare USA (DHMO): Is It Worth It?

This is Delta’s copay-based plan. It’s best suited for people who prioritize affordability and routine care.

Pros:

- Lower premiums

- Predictable copays

- No claims or deductibles

Cons:

- Must use assigned in-network provider

- Fewer dentists to choose from

- Limited or no coverage for procedures like Invisalign, implants, or out-of-network specialists

Great for families on a budget or people with minimal dental needs.

Cost vs. Value: Does It Pay for Itself?

Let’s do some quick math.

Monthly Premiums:

- PPO: $30 to $60 per month

- DHMO: $10 to $30 per month

Common Procedure Costs Without Insurance:

- Cleaning: $100

- Filling: $150

- Crown: $1,200

- Root canal: $1,000 to $1,500

If you or your kids visit the dentist twice a year, get a filling, or need any restorative work, you’re likely to break even or come out ahead.

Who Is Delta Dental Best For?

1. Families with kids, Especially those who might need orthodontic treatment.

2. Adults with occasional dental needs — Cleanings, fillings, or the odd crown

3. Seniors needing implants or dentures — PPO plans can offer strong value with partial implant coverage

When Delta Dental Might Not Be Worth It

- You rarely go to the dentist

- Your preferred dentist isn’t in-network and you have a DHMO

- You only want cosmetic services like whitening or veneers

- Your employer plan is weak, and a discount dental plan offers better value

Delta Dental vs. Discount Dental Plans

Not all dental coverage is created equal.

Delta Dental:

- Traditional insurance model

- Premiums, claims, reimbursement

- Broader protection for major dental work

Discount Dental Plans:

- Not insurance

- You pay a membership fee to get access to discounted services

- Lower upfront cost, but you pay most of the bill out-of-pocket

Discount plans can work if you want cosmetic work or only need cleanings. But if you’re facing a root canal or crown, Delta Dental wins.

Real User Experiences: What People Like and Don’t Like

The Good:

- Preventive care is almost always fully covered

- Easy to find providers in PPO network

- Reliable claims processing

The Not-So-Good:

- Low annual maximums

- Waiting periods can delay treatment

- DHMO provider options may be limited

How to Get the Most from Your Delta Dental Plan

- Use your two cleanings per year — they’re free under most plans

- Schedule major work over two benefit years to avoid maxing out

- Get pre-approvals for big treatments

- Stay in-network for better pricing

- Use FSA or HSA funds to cover out-of-pocket costs

Looking for Delta Dental Providers in Humble, TX?

At Humble Memorial Dental, we proudly accept Delta Dental PPO and DeltaCare USA plans.

We can:

- Verify your benefits before treatment

- Help you understand what’s covered

- Submit pre-treatment estimates

- Work with your budget to optimize your care

Book your appointment today and get the care you deserve, backed by insurance that makes sense.

Final Thoughts

Delta Dental can be worth every penny, but only if you understand your plan and use it wisely.

If you’re someone who takes advantage of preventive visits, might need a crown or two, or has a kid who may need braces, you’ll likely save more than you spend. Just make sure to read the fine print, choose the right provider, and time your treatments smartly.

And if you’re unsure? Ask your dentist. A good dental office (like ours) can help make your insurance work harder for you.